Inside Super 2 – Direct-to-consumer: remaining relevant in the future of super distribution

Consumers’ choice coupled with policy changes place pressure on wholesale distribution channels

In past decades, wholesale distribution channels – the industrial machinery – have been the key enabler of member account growth in industry super, while retail funds relied heavily on marketing through their advisor channels.

Today, traditional distribution channels in the industry super sector face pressure from changes in policy and consumer preferences, exacerbating the need for funds to develop their direct-to-consumer distribution capabilities and presence to maintain organic member growth.

In recent years, the government has arguably intensified a long-term push to dismantle the traditional default distribution system. If these efforts are successful, funds believe that proposed changes such as ‘Best in show’ or the ‘One fund at a time’ would disrupt the dynamics of the superannuation market and the way funds acquire members.

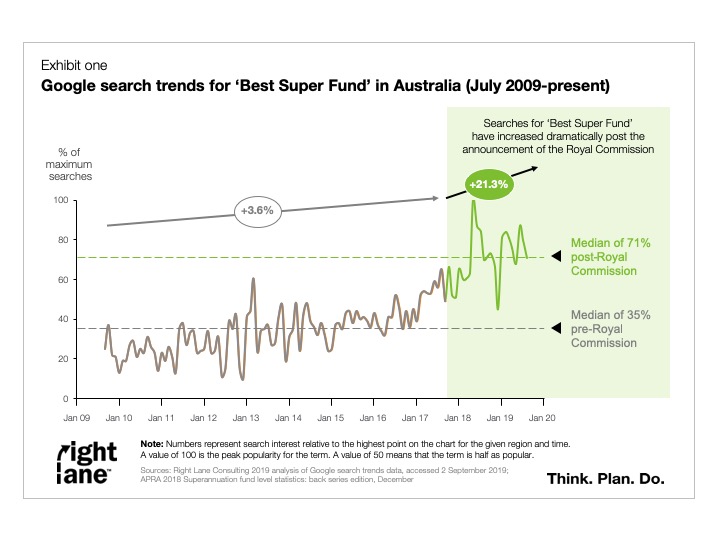

In parallel, members appear to be more engaged in choosing their super fund (as opposed to defaulting). Emblematic of this trend, since the announcement of the Royal Commission, searches for ‘Best Super Fund’ have increased dramatically (see exhibit one). This surge in superannuation engagement has been reinforced by a ‘snowball’ of interrelated forces that increase the ease and propensity for members to switch super providers – including the availability of enabling technology, more visible brands, and greater transparency of performance data.

Only two funds appear to be winning the battle for consumers exercising choice

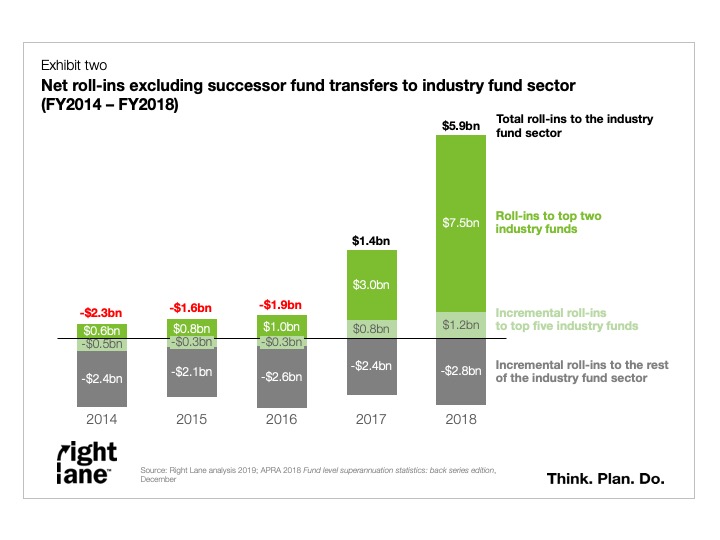

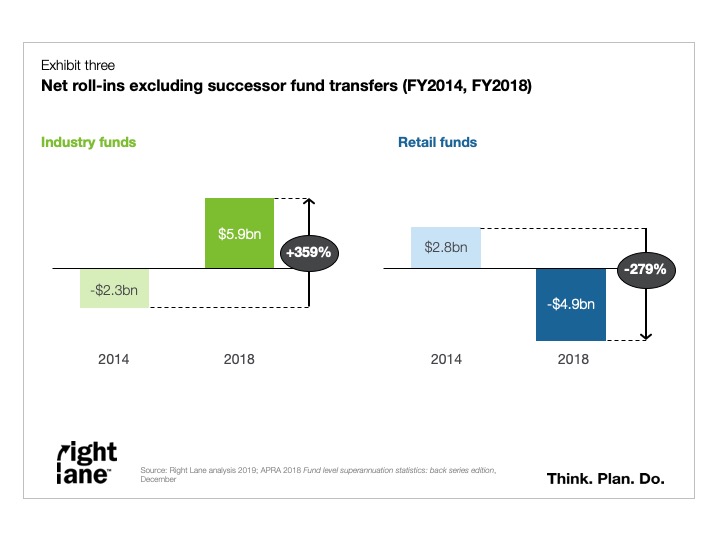

It would appear that this increase in switching activity is largely benefiting only a couple of industry funds, who have seen record amounts of cash inflows recently (see exhibit two), mostly at the expense of the retail funds that came under intense scrutiny during the Royal Commission (see exhibit three).

In the battle for scale, the importance of direct-to-consumer distribution will only increase

It sounds like a hollow truism to say that non-traditional distribution has never been more important; but it is demonstrably true. Due to policy change, and a confluence of behavioural and technological forces, traditional industrial and employer channels can no longer be relied upon the way they once could.

In a world where intermediated workplace channels are no longer the only route to market, the challenge for many funds is to rapidly develop a more agile, direct-to-consumer distribution model that will allow them to remain relevant and succeed in this new environment.

Right Lane can help your fund build the capability and adaptability in the new direct-to-consumer marketplace, while supporting the culture and skillsets needed now and in the near future.

Some of the questions we help funds answer include:

- What is the size of the direct-to-consumer distribution opportunity?

- Where should we look for opportunities?

- What consumer segments should we target now, and how?

- How can we uncover the real needs and preferences these consumers have?

- How can we design compelling solutions that meet consumers’ needs?

- What processes and capabilities are needed to develop new products or solutions to capture these opportunities?

Get in touch with us to discuss how we can help you build a successful direct-to-consumer distribution channel.

About Abhishek Chhikara

Abhishek is a Senior Associate with Right Lane with deep experience in strategic thinking and planning, operating model design, and organisational effectiveness. In his time at Right Lane, Abhishek has worked with over 50 clients on more than 100 consulting projects. Abhishek has extensive experience in consulting to profit-for-member superannuation, having served 15 superannuation funds and fund service providers on nearly 70 projects, ranging from board strategy offsites to investment team capability building. He has a particular interest in investment management and has worked with investment teams of three funds on projects relating to portfolio and operating model strategy, execution effectiveness, and business case development.

Abhishek has also played a leading role in Right Lane’s thought leadership in superannuation, contributing to the Right Lane’s work on retirement incomes and the development of recent editions of Right Lane’s annual Industry Super Forces at Work report.

Right Lane: The purpose-driven consulting firm exclusively serving industry super funds

- We have served industry funds exclusively for almost 20 years: Industry super is one of our core areas of expertise; we have served more than 20 not for profit funds on more than 300 projects, and worked with their service providers in administration, funds management, group insurance, advocacy and banking. We understand deeply the context within which you operate.

- We have unparalleled knowledge of your operating context: We produce a leading body of work on sector trends to which most large industry funds subscribe; to our knowledge, we have served more profit-for-member funds on topics relating to strategy, outcomes measurement and accountability than any other consulting firm.

- We unlock value through a commitment to highly inclusive processes: Our approach ensures high engagement, and results in strong buy-in to the outcomes.

- We have top-tier consulting credentials: Our consultants all come from top-tier management consulting firms or were trained by them. Since our firm was established, more than 70% of our non-graduate consulting staff have previously worked for McKinsey, BCG, Booz (Strategy &), A.T Kearney, or LEK.

- We are an ethical consulting firm choosing to only serve profit to member super funds. We are aligned to the values of industry super and stand by our commitment to the network.

Previous ‘Inside Super’ insights are available here:

Inside Super 1 – From strategy to SEAR: regulatory overreach or reasonable expectations?

We hope the ideas presented here have given you something new to think about. We would love the opportunity to discuss them with you in more detail. Get in touch today.