Inside Super 1 – From strategy to SEAR: regulatory overreach or reasonable expectations?

Over the past 12 months, and with no signs of slowing down, APRA has been prescribing guidelines relating to the processes we work on every day: strategic and business planning, outcomes assessment and measurement, and group and individual accountability. For example:

- SPS 515 makes member outcomes central to the strategic planning and budgeting process and proposes methods to ensure the planned strategy is rigorously implemented and the budget is well managed;

- SPG 516 guides how those member outcomes are articulated, measured, assessed and connected to the strategic planning process; and

- the forecast superannuation executive accountability regime (SEAR) will hold executives and trustees accountable for the activities they undertake, the expenses they incur and the outcomes they deliver.

While some funds may consider this overly prescriptive regulatory overreach, we believe the gist of the regulations is not unreasonable. These regulations share a common underlying goal: for funds to be clear on what they are striving to achieve, how they intend to achieve it, and who is responsible for delivering the work. This is surely common sense, and in the case of most funds, common practice; although in our experience by reflecting on the intent of the regulations, including the link between activity and outcome, funds can identify opportunities for improvement. For example, in one recent project we supported a fund to improve the frequency and depth with which they review their strategic activities; and we supported another fund to strengthen the link between their strategic objectives, their measures scorecard, and their executive accountabilities.

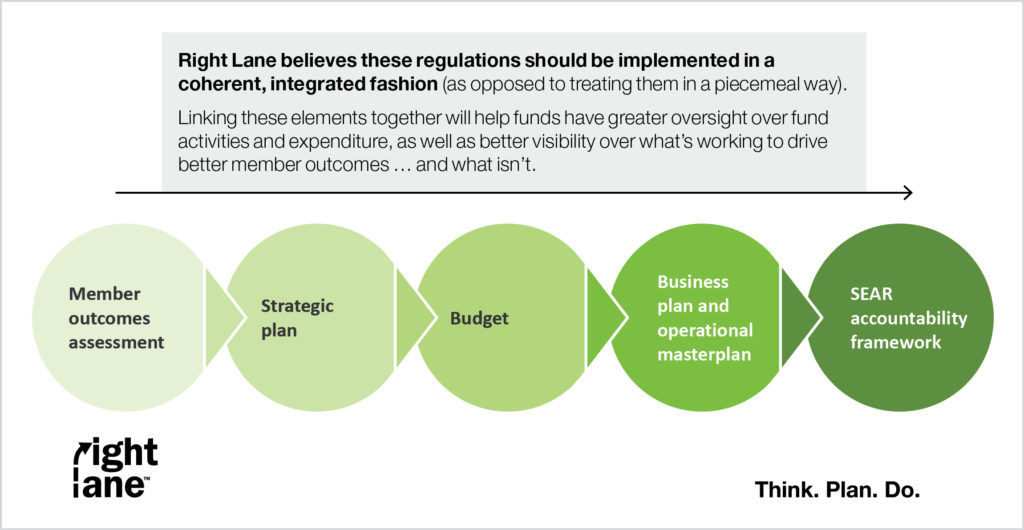

With so much new regulation, the challenge for most funds is to meet these regulatory requirements in an integrated manner that achieves better results for members.

Right Lane believes these regulations should be implemented in a coherent, integrated fashion (as opposed to treating them in a piecemeal way). This means, consulting with key stakeholders to define desired member outcomes, linking those outcomes to the activities of the fund, prioritising those activities in a coherent strategy, and assigning accountability for delivery of that strategy. Linking these elements together will help funds have greater oversight over fund activities and expenditure, as well as better visibility over what’s driving better member outcomes … and what isn’t.

Working collaboratively with funds, Right Lane’s integrated approach gives rise to three complementary deliverables:

- A single, coherent view of the fund’s role in delivering improved member outcomes

- A planning and budgeting process that leverages industry best practice and is tailored to the size, complexity and operating rhythms of the specific fund

- An accountability framework that highlights individual and team contributions to discreet member outcomes, and provides a robust mechanism for assessing the effectiveness of their efforts.

Do it right and your integrated approach can support coherent decision making with a clear view of the trade-offs and implications, and foster accountability for tangible outcomes to members. It moves the focus from simply delivering activities, to shifting the dial on critical member outcomes.

Let’s work together to demystify the regulation and integrate your approach. Get in touch with Right Lane’s director and leading expert on superannuation Marc Levy to conduct a health check of your current processes. Right Lane can help your fund leverage the best parts of its current approach, and adapt where required to meet these regulatory requirements and deliver the best possible outcomes for members.

Marc Levy, Director

P: 03 9428 5336 or marc@rightlane.com.au

About Dr Marc Levy

Marc is the founding director of Right Lane Consulting. He has played leading roles in approximately 100 strategic and business planning processes and more than 500 management and board workshops. To our knowledge, there is no more experienced leader of strategy and planning processes in the country, and Marc is one of a handful of top team strategy facilitators globally with more than 10,000 hours of experience in this discipline.

Marc has been serving profit to members super funds – and their service providers in asset consulting, administration, banking, advice, advocacy, group insurance and funds management – on strategy, organisation and growth projects since 2001. During that time he’s played leading roles in more than 200 projects in the sector.

Right Lane: The ethical consulting firm exclusively serving industry super funds

- We have served industry funds exclusively for almost 20 years: Industry super is one of our core areas of expertise; we have served more than 20 not for profit funds on more than 300 projects, and worked with their service providers in administration, funds management, group insurance, advocacy and banking. We understand deeply the context within which you operate. Since the release of SPS 515, we have supported several industry funds with their integrated approach.

- We have unparalleled knowledge of your operating context: We produce a leading body of work on sector trends to which most large industry funds subscribe; to our knowledge, we have served more profit-for-member funds on topics relating to strategy, outcomes measurement and accountability than any other consulting firm.

- We unlock value through a commitment to highly inclusive processes: Our approach ensures high engagement in the process, and results in strong buy-in to the outcomes.

- We have top-tier consulting credentials: Our consultants all come from top-tier management consulting firms or were trained by them. Since our firm was established, more than 70% of our non-graduate consulting staff have previously worked for McKinsey, BCG, Booz (Strategy &), A.T Kearney, or LEK.

- We are an ethical consulting firm choosing to only serve profit to member super funds. We are aligned to the values of industry super and stand by our commitment to the network.

We hope the ideas presented here have given you something new to think about. We would love the opportunity to discuss them with you in more detail. Get in touch today.