Budget changes picking ‘winners’ and ‘losers’ in the super system

by Abhishek Chhikara

Inside Super: The changes announced in the recent Budget, aimed at improving efficiency in the super system, are in essence picking the ‘winners’ and the ‘losers’ in the system.

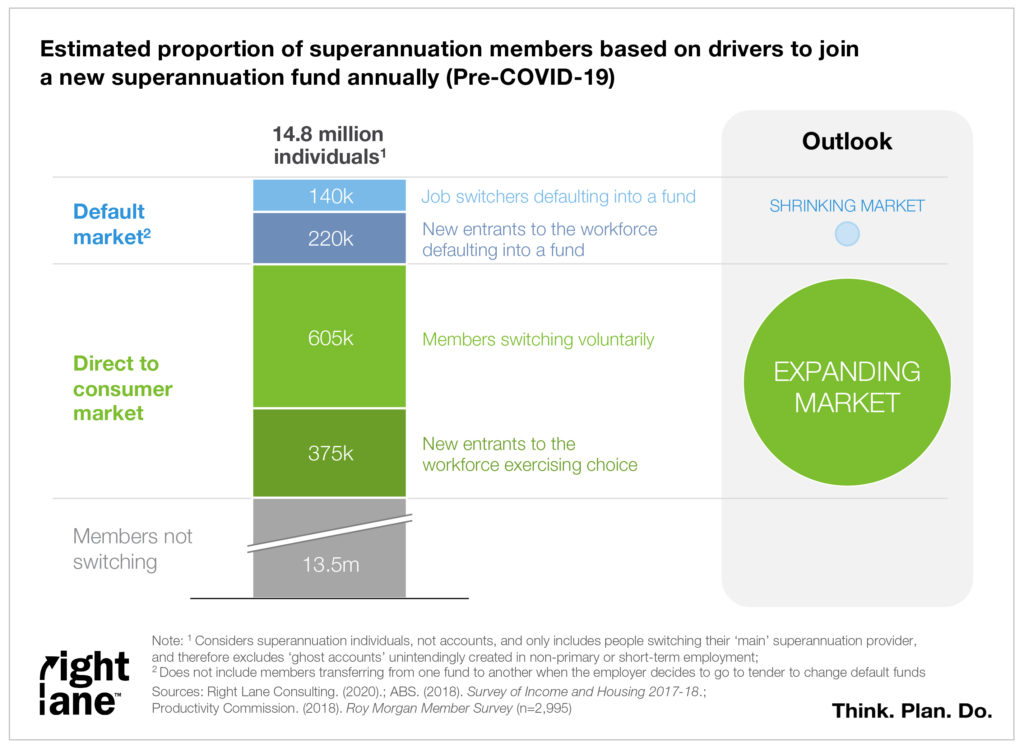

The stapling of accounts and spotlight on fees and performance is likely to escalate switching behaviour while reducing the prominence of the default distribution market, which may shrink to less than 220,000 accounts annually.

The battle ground for member acquisition will shift to ‘direct to consumer’ distribution, a market which is estimated to be approximately 1 million accounts annually, currently dominated by a handful of large funds.

The changes announced were: stapling of accounts; a spotlight on fees and performance; consequences for underperformance; and increasing transparency and accountability.

Stapling of accounts means that unless they choose, members will continue to receive contributions to their existing fund even in the event of a job change, to reduce duplicate accounts in the system. This is likely to favour funds appealing to younger membership demographics at the start of their careers, virtually eliminating the default market segment of around 140,000 workers switching funds due to a change in employment each year.

Stapling of accounts will tie a member’s fate to their existing or first fund unless they exercise choice and switch providers.

The number of members exercising choice has been increasing for a few years, with recent estimates suggesting around 605,000 workers annually actively choosing to switch superannuation providers, in addition to around 375,000 new entrants to the system that actively choose a fund each year.

The spotlight on fees and performance will intensify this switching behaviour.

The new battle for funds will be winning market share of potentially 1 million annual ‘choosers’, currently dominated by a handful of large industry funds. The default market is likely to shrink to only the new entrants to the system each year that do not exercise choice, estimated to be less than 220,000 workers. With a bleak outlook for employment and migration, this number could be even lower.

The changes may lead to a relatively undifferentiated system that may not be optimal for competition.

These changes will help solidify the position of large, fast growing funds – with the capability to invest in direct member acquisition, the capacity to invest in the ever-growing compliance requirements, and the courage to persevere in the face of ever growing scrutiny.

For the rest, the prospect of a long slow decline is likely to create a greater sense of urgency to consolidate.

It is easy to imagine these changes leading to a relatively undifferentiated system with a few mega funds. But will it be optimal for competition?

Our research suggests otherwise. We believe an ideal system will comprise between 3 and 5 mega-funds plus between 8 and 10 specialist funds that serve a specific group or offer a specific value proposition, all above minimum efficient scale.

Such a system, not too fragmented and not too consolidated, will deliver an optimal mix of competitiveness and efficiency, something we all agree that the system needs.

About Abhishek Chhikara

Abhishek is an Associate Principal with Right Lane with deep experience in strategic thinking and planning, operating model design, and organisational effectiveness. In his time at Right Lane, Abhishek has worked with over 50 clients on more than 100 consulting projects. Abhishek has extensive experience in consulting to profit-for-member superannuation, having served 15 superannuation funds and fund service providers on nearly 70 projects, ranging from board strategy offsites to investment team capability building. He has a particular interest in investment management and has worked with investment teams of three funds on projects relating to portfolio and operating model strategy, execution effectiveness, and business case development.

Abhishek has also played a leading role in Right Lane’s thought leadership in superannuation, contributing to Right Lane’s work on retirement incomes and the development of recent editions of Right Lane’s annual Industry Super Forces at Work report.

Previous ‘Inside Super’ insights are available here:

Inside Super 1 – From strategy to SEAR: regulatory overreach or reasonable expectations?

Inside Super 2 – Direct-to-consumer: remaining relevant in the future of super distribution

Inside Super 2 (UPDATE) – Direct-to-consumer: remaining relevant in the future of super distribution

Inside Super 3 – SPS 515 puts the spotlight on strategy execution

Inside Super 4 – Cash crunch! Industry funds may need to raise fees or reduce costs

We hope the ideas presented here have given you something new to think about. We would love the opportunity to discuss them with you in more detail. Get in touch today.