Cash crunch! Industry funds may need to raise fees or reduce costs

Cash crunch! Industry funds may need to raise fees or reduce costs, both of which are likely to hamstring their ability to compete in the future.

Account consolidation and legislative changes are placing pressure on funds’ fee models, putting their business models at risk.

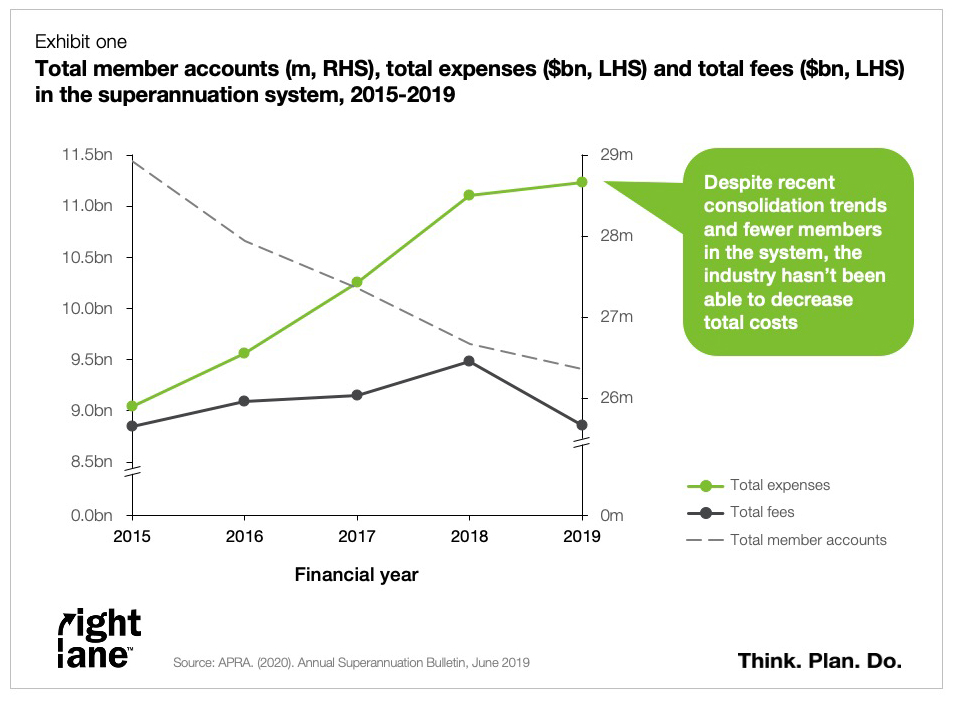

At a system level, funds are experiencing an increasing gap between total expenses and total fees due to a decline in total member accounts. In the past five years, total expenses grew by 6% CAGR, while the total number of member accounts declined by 2% CAGR, total revenues declined by 1% CAGR (see exhibit one).

This issue is likely to be exacerbated by a fundamentally more expensive business model required to meet members, regulators and other stakeholders’ expectations and to compete with more aggressive rivals.

Many industry funds appear to be exposed to a cash crunch.

Industry funds are likely to face increasing pressure on their fee models, with:

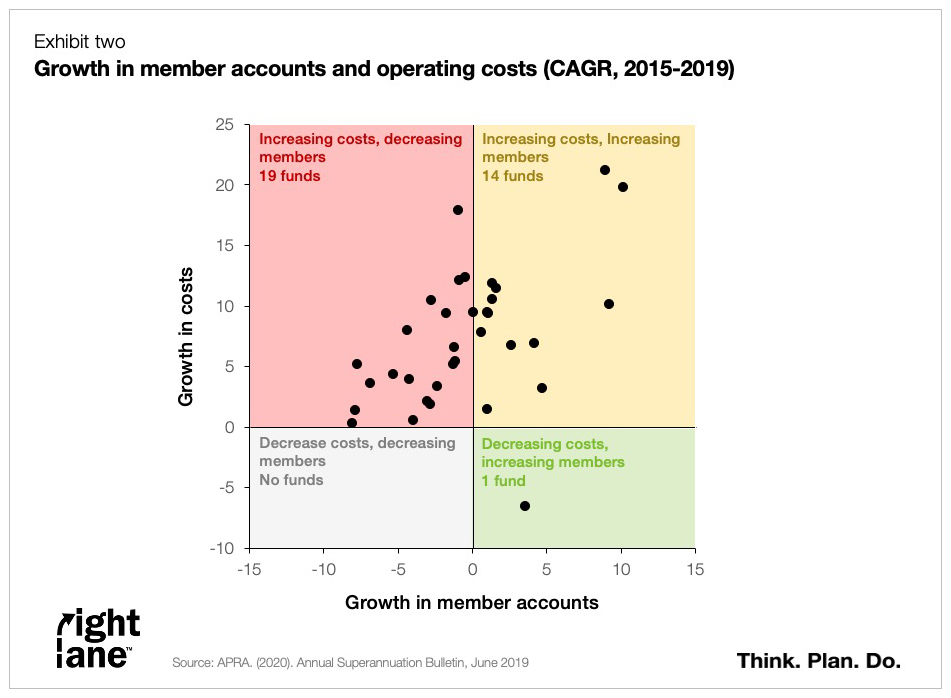

- 19 out of 34 funds (41%) growing costs despite a decrease in their overall membership

- 14 out of 34 funds (56%) growing costs faster than membership

- 1 out of 34 funds (3%) reducing costs, while growing their members (see exhibit two).

A cash crunch would be exacerbated for funds who are overly reliant on asset-based fees if there is a period of low or negative returns, or funds who have a large portion of inactive members that consolidate ‘away’ from them.

The cash crunch presents a quandary for industry funds – to raise fees or to lower costs, both of which are likely to hamstring their ability to compete.

Raising fees at a time when retail funds are streamlining their businesses and lowering fees to gain back lost ground might be a misstep for funds if they don’t have a strong and defensible value proposition for their members.

Lowering costs, on the other hand, may result in an underinvestment in capabilities necessary to compete for members, placing further pressure on their revenue models.

For many funds, continuing with their existing cost and revenue models may only possible if they have built up sizeable reserves, but depleting reserves will only postpone the inevitable.

This analysis is an excerpt from Right Lane’s 2020 Industry Super Forces at Work report, set to be released in early March.

This is the eighth year Right Lane has conducted research on the forces impacting industry super funds. The report is based on our research and reflections on our work with more than 20 industry super funds and many of their service providers over the past 20 years. In developing this year’s report, we interviewed the CEOs of many of our industry fund and collective vehicle clients. We thank them for their helpful input, the majority of which has been incorporated into the final report, and for their ongoing support of this work.

We believe it to be the best available material on the forces at work impacting not for profit super. Many subscribers use the report for board and executive team offsites, and also as a knowledge resource for current and future leaders.

Your fund may already subscribe to the report. If you are not sure, or if you would like Right Lane to present it to your team, please contact me through the link below.

Abhishek Chhikara, Associate Principal

P: 03 9428 5336 or abhishek.chhikara@rightlane.com.au

About Abhishek Chhikara

Abhishek is an Associate Principal with Right Lane with deep experience in strategic thinking and planning, operating model design, and organisational effectiveness. In his time at Right Lane, Abhishek has worked with over 50 clients on more than 100 consulting projects. Abhishek has extensive experience in consulting to profit-for-member superannuation, having served 15 superannuation funds and fund service providers on nearly 70 projects, ranging from board strategy offsites to investment team capability building. He has a particular interest in investment management and has worked with investment teams of three funds on projects relating to portfolio and operating model strategy, execution effectiveness, and business case development.

Abhishek has also played a leading role in Right Lane’s thought leadership in superannuation, contributing to Right Lane’s work on retirement incomes and the development of recent editions of Right Lane’s annual Industry Super Forces at Work report.

Previous ‘Inside Super’ insights are available here:

Inside Super 1 – From strategy to SEAR: regulatory overreach or reasonable expectations?

Inside Super 2 – Direct-to-consumer: remaining relevant in the future of super distribution

Inside Super 2 (UPDATE) – Direct-to-consumer: remaining relevant in the future of super distribution

Inside Super 3 – SPS 515 puts the spotlight on strategy execution

We hope the ideas presented here have given you something new to think about. We would love the opportunity to discuss them with you in more detail. Get in touch today.