Inside Super: The implications of scale

30 years on from the introduction of Australia’s compulsory superannuation system, assets under management are $3.4 trillion and the implications of scale are becoming clear.

In 1992, Australia’s top single was Billy Ray Cyrus’s Achy Breaky Heart. The Late Show premiered on ABC television. ‘The Woodies’ won the men’s doubles at the Australian Open, played at Flinders Park.

The same year, Australia’s total superannuation assets were less than $245 billion. And compulsory superannuation was introduced in July. It’s difficult to know whether our cultural tastes have in fact improved since 1992, though we are living through a golden age of Australian tennis.

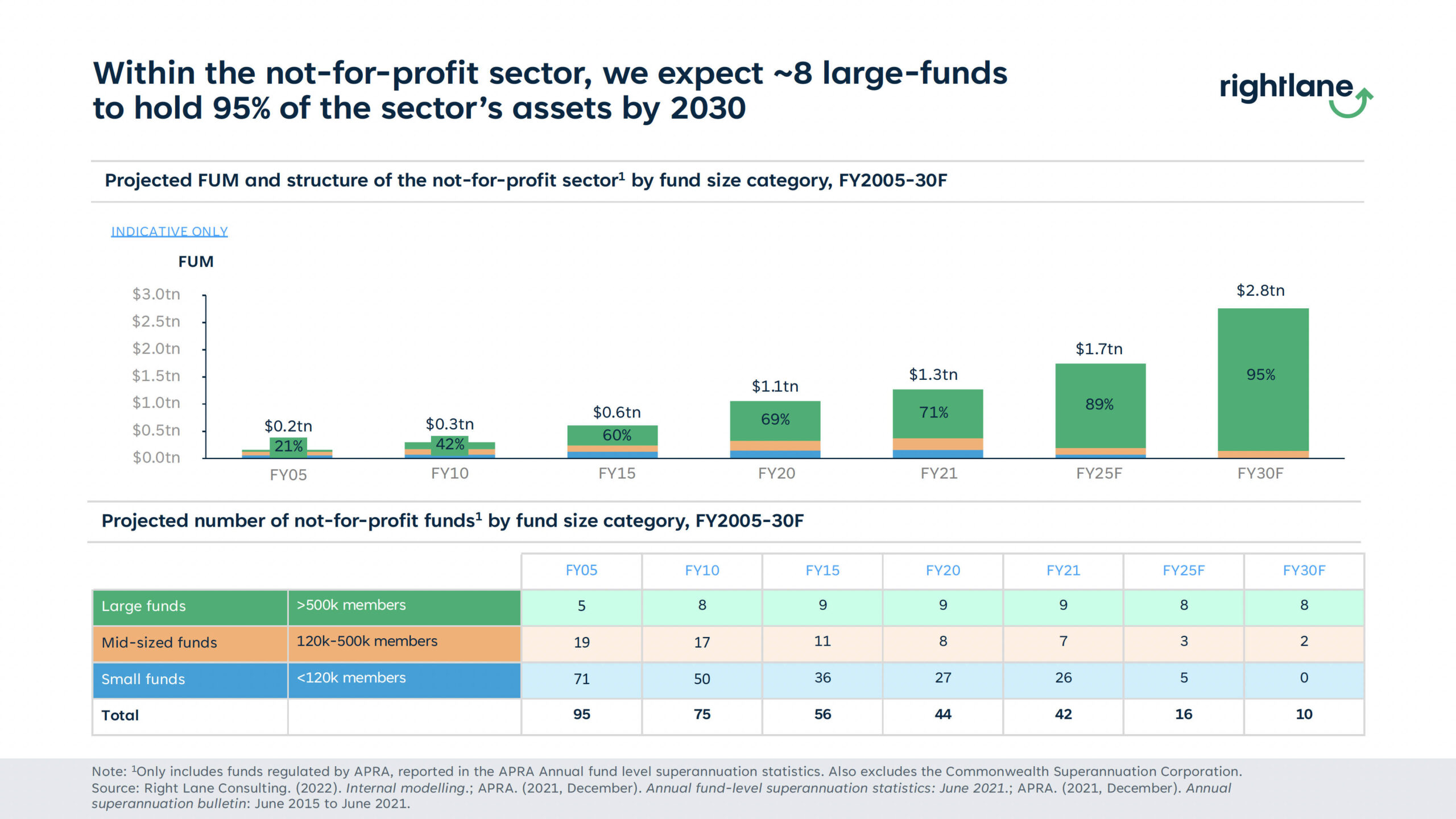

30 years on from the introduction of Australia’s compulsory superannuation system, assets under management are $3.4 trillion and its structural shape is becoming clear. Based on current trends, we appear to be set to have a system comprised of 10-15 large funds, from 42 funds today. In 2005, there were 95 funds. The implications of scale are becoming increasingly apparent.

At the same time, we anticipate that industry funds alone will be responsible for managing $2.8 trillion of a total of $6.1 trillion in 2030. The rate of merger activity, spurred on by competitive developments and regulation including the annual APRA performance test, has been transformative.

Two of the original architects of the compulsory superannuation system, Paul Keating and Bill Kelty recently declared that 10 mega funds would dominate our financial system. Keating remarked that, ‘If we do this right, we’ll have half a dozen massively capitalised, competent bodies picking up international opportunities all over the place, funding this back into Australia through the superannuation system.’

But with scale comes risk, and responsibility.

As funds gain more significance as a proportion of the total superannuation system and the broader economy, scrutiny will only intensify. Government and regulators will continue to shine a light on governance, investments and risk strategies of funds. On the one hand, small funds will be forced to justify their competitive advantage, or merge. On the other hand, the implications of scale will flow through into questions over investment choice, capital concentration and operational complexity, among others. For mega funds with expanded in-house teams working on everything from investment to strategy, across global operations, clear accountability, delegations and decision-making lines will be key. Despite reporting that the ‘super wars’ are over, the financial press will continue its forensic investigations into fund investments and decision making.

Large funds face global competition for assets. Funds are also facing fierce competition to attract the right people, in a tight labour market with ongoing challenges in respect of migration.

Finally, funds are already living the complexities of integration. Go with the same provider of one fund because it’s less expensive but not providing the service that you would like? Integrate IT systems at the time of the merger, or do it in stages with the inefficiencies that entails but lesser risk? And how to bring people together in a way that inspires confidence and a shared understanding of what the new organisation wants to achieve, what it means to work there?

All hard. All entail constant attention and often difficult decisions. But the new dawn is upon us. The times are very different to what they were in 1992.

Looking ahead to 2023 – Right Lane Forces at Work report

Our annual Super Forces at Work report, due to be published in early 2023, will contain a deeper dive into key issues in super including examining the size of the system, impact of mergers, and the gendered impact of the workforce changes arising from COVID. To read our 2022 report, click here

Note that access to the report is based on a subscription. To check whether your fund/organisation holds a subscription, please contact us on 03 9428 5336.

Right Lane Consulting has a deep knowledge of the superannuation sector, working with not-for-profit funds across the scale spectrum. We first shared publicly our evidence-based insights on whether scale efficiencies were being realised in a consolidating superannuation environment in August 2012 and have been active participants in the debate on system structure since. Right Lane can assist in helping you to navigate these challenges and decisions and would be pleased to discuss this with you.

About Gemma Pinnell

About Gemma Pinnell

Gemma is a principal at Right Lane Consulting. She has worked in senior positions in superannuation and the labour movement for over two decades.

Prior to joining Right Lane, Gemma was Director, Strategic Engagement at Industry Super Australia (ISA) where she was responsible for strengthening relationships between ISA and key stakeholders. During this time, she led major initiatives for ISA across a range of stakeholder, governance and engagement strategies. She has a particular focus on gender and affordable housing advocacy work.

gemma.pinnell@rightlane.com.au

About Dr Emily Millane

Emily Millane is an expert in superannuation policy and law. She is a Senior Superannuation Specialist working in our super and institutional investors practice, consulting with clients and helping to amplify our reputation in this growing sector.

As well as her work at Right Lane, Emily is a Senior Fellow at the University of Melbourne Law School, teaching Superannuation Law and Regulation. Emily’s PhD (ANU) examined the conditions for systemic policy reform using the case study of Australian superannuation.

emily.millane@rightlane.com.au

For more information about Right Lane’s industry superannuation practice visit https://www.rightlane.com.au/inside-super/