Inside Super: The evolving role of superannuation in the Australian economy.

2022 has been a year when the economic impacts of superannuation have played out in national politics in very prominent, and different, ways.

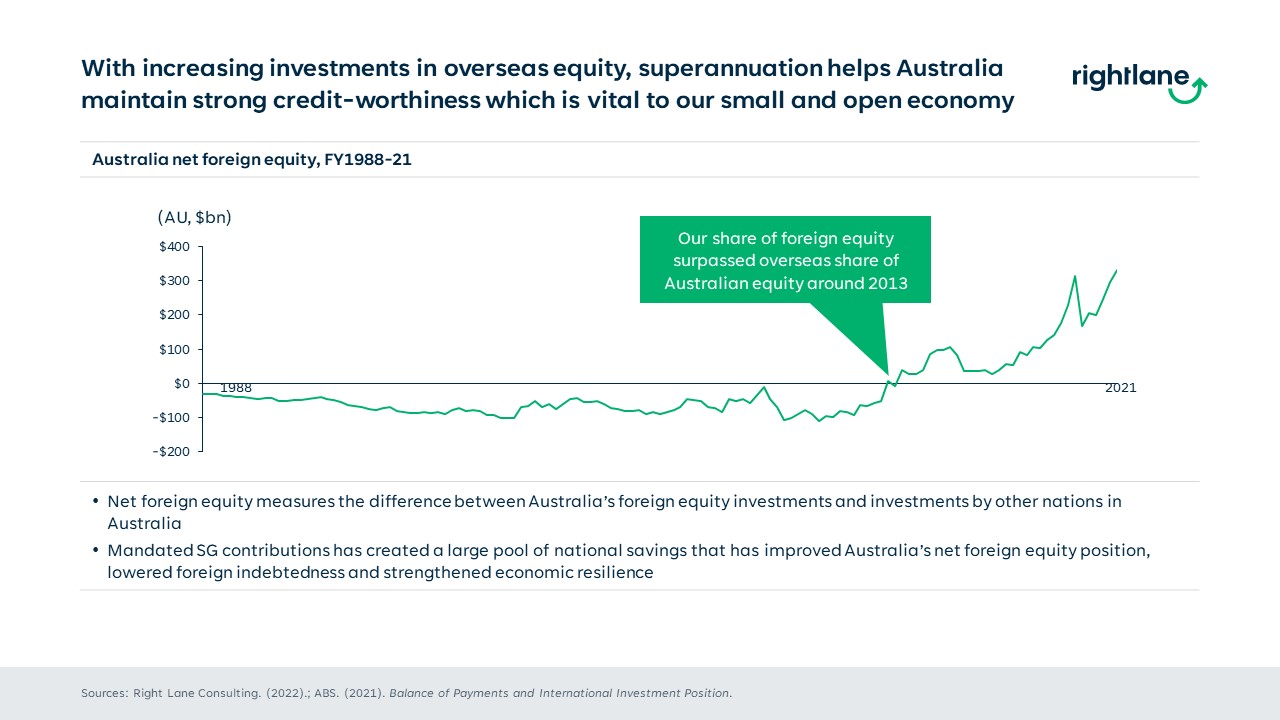

Superannuation funds are shaping the economy. They own 34% of equities on the ASX. Significant investments continue to be made into unlisted assets, representing integral components of the Australian economy, including roads, airports and logistics. With increasing investments in overseas equity, superannuation helps Australia maintain strong creditworthiness that is vital to our small and open economy.

Just as award superannuation was originally used in the 1985 Accord to manage inflation, it is being used in the 2022 National Housing Accord to create opportunities for super funds to contribute to investment in housing affordability schemes.

2022 has been a year when the economic impacts of superannuation have played out in national politics in very prominent, and different, ways.

In February, the Senate voted to disallow the then Treasurer’s proxy advice regulations that would have required proxy advisers to provide companies with a written copy of their advice on the same day it was provided to clients, and to be independent of their clients. The regulations followed much-publicised interventions by superannuation funds in the companies they hold equity in, concerning executive remuneration and environmental matters. The regulations were in place for a total of three days.

We have seen some of the most significant mergers in the history of superannuation, with the establishment of Australian Retirement Trust (ART), meaning Australia now has two super funds with over $200 billion each in funds under management. Other mergers completed or in progress this year include AustralianSuper and LUCRF, UniSuper and Australian Catholic Super and HESTA and Mercy Super.

Superannuation funds are shaping the economy. They own 34% of equities on the ASX. Significant investments continue to be made into unlisted assets, representing integral components of the Australian economy, including roads, airports and logistics. With increasing investments in overseas equity, superannuation helps Australia maintain strong credit-worthiness that is vital to our small and open economy.

Superannuation assets have accounted for over 45% of the average household’s net wealth growth in Australia between 2010 and 2018. According to ASFA, superannuation is now households’ most important asset after the family home and for most low-income earners, superannuation provides their only exposure to growth assets that they would either not have access to or, if they did have access, they would face much higher fees.

In the second half of 2022, and with a new federal government in power, we witnessed a very different turn of superannuation policy. In August, new Treasurer Jim Chalmers attended the annual Superannuation Lending Roundtable hosted by the Financial Review and packaging multinational, Visy. The Treasurer noted that in superannuation, we have ‘trillions of dollars of capital looking for a home…a system bigger than Canada’s as a share of GDP. We are top three in pension asset pools despite being the 13th biggest economy.’

This was followed by a federal budget in October that opened up a conversation about the role of superannuation funds in the Australian economy. The Government announced a National Housing Accord with the aim of increasing supply of housing in a squeezed market. The Accord includes a commitment to examine barriers to institutional investment in housing, including for superannuation funds.

Just as award superannuation was originally used in the 1985 Accord to manage inflation, it is being used in the 2022 Accord to try and manage housing affordability.

The conundrum facing institutional investors investing in affordable housing is not new. One senior superannuation fund executive quipped this year that superannuation funds have been trying to crack the affordable housing nut ‘for about as long as we have had the SG.’

It hardly bears repeating for those in the industry, but superannuation funds operate under the regulatory regime including the sole purpose test. They must be able to show that they make investments that are in the best financial interests of members. Trustees cannot make an investment that returns less than the market rate, as they would be doing if they invested in housing for those who do not pay market rate. The government can step in to make up the difference. And therein lies the logic for the Housing Accord.

With echoes of the public-private partnerships era of public policy, the Albanese government has established an Investor Roundtable to ‘bring together leaders from the investment community, including from some of Australia’s largest superannuation funds, the major banks and global asset managers, to identify and overcome barriers to investment.’

On the other side of parliament, allowing first home buyers to use their superannuation for housing remains Coalition policy, confirmed in Peter Dutton’s Budget Reply.

Whatever happens in 2023, it will pay to have superannuation and housing on your bingo card. Superannuation funds will need to carefully consider their obligations while navigating new opportunities that present themselves as Australia’s superannuation assets continue to grow, and represent a more sizeable, attractive pool of long-term capital.

Our annual Super Forces at Work report, due to be published in early 2023, will contain a deeper dive into key issues in super including examining the size of the system, impact of mergers, and the gendered impact of the workforce changes arising from COVID. To read our 2022 report, click here

Note that access to the report is based on a subscription. To check whether your firm holds a subscription, please contact us on 03 9428 5336.

Right Lane Consulting has deep knowledge of the superannuation sector, working with not-for-profit funds across the scale spectrum. We first shared publicly our evidence-based insights on whether scale efficiencies were being realised in a consolidating superannuation environment in August 2012 and have been active participants in the debate on system structure since. Right Lane can assist in helping you to navigate these challenges and decisions and would be pleased to discuss this with you.

About Gemma Pinnell

Gemma is a principal at Right Lane Consulting. She has worked in senior positions in superannuation and the labour movement for over two decades.

Prior to joining Right Lane, Gemma was Director, Strategic Engagement at Industry Super Australia (ISA) where she was responsible for strengthening relationships between ISA and key stakeholders. During this time, she led major initiatives for ISA across a range of stakeholder, governance and engagement strategies. She has a particular focus on gender and affordable housing advocacy work.

gemma.pinnell@rightlane.com.au

About Dr Emily Millane

Emily Millane is an expert in superannuation policy and law. She is a Senior Superannuation Specialist working in our super and institutional investors practice, consulting with clients and helping to amplify our reputation in this growing sector.

As well as her work at Right Lane, Emily is a Senior Fellow at the University of Melbourne Law School, teaching Superannuation Law and Regulation. Emily’s PhD (ANU) examined the conditions for systemic policy reform using the case study of Australian superannuation.

emily.millane@rightlane.com.au

For more information about Right Lane’s industry superannuation practice visit https://www.rightlane.com.au/inside-super/